Siti scommesse online 2024: Migliori bookmakers con licenza Italiana AAMS / ADM

Scopri ora i migliori siti scommesse AAMS del 2024!

La domanda che ti stai ponendo è quali sono i migliori siti di scommesse con licenza italiana AAMS? La risposta è molto semplice ma anche soggettiva. Ma partiamo dalla base.

Nell'era digitale in cui viviamo, il mondo delle scommesse sportive ha subito una trasformazione epocale, passando dai tradizionali bookmaker a una vasta gamma di opzioni online.

Sommario

- Lista dei migliori siti di scommesse sportive online in Italia 2024

- Siti di Scommesse con Bonus Attraenti

- Siti di scommesse legali in Italia

- Alla Scoperta dei Bookmakers online che sono legali in Italia

- Come Valutare i Siti di Scommesse online?

- Quali sono gli venti dove posso scommettere on line legalmente in Italia?

- Alternative alle scommesse convenzionali in Italia:

- La Mia Esperienza con la Regolamentazione dei Siti di Scommesse in Italia

- Domande Frequenti

Lista dei migliori siti di scommesse sportive online in Italia 2024

| Bookmaker | Bonus | Sito Web |

|---|---|---|

| Admiralbet | €150 | VISITA |

| Casombie | €500 | VISITA |

| Gioco Digitale | €100 | VISITA |

| 22bet | €122 | VISITA |

| Platinobet | €30 | VISITA |

| Staryes | €1.050 | VISITA |

| LeoVegas | €150 | VISITA |

| Sisal | €100 | VISITA |

| Eurobet | €100 | VISITA |

| William Hill | €150 | VISITA |

| Mystake | €150 | VISITA |

| Netbet | €150 | VISITA |

AdmiralBet, precedentemente noto come AdmiralYes, si rinnova nel panorama del gaming online, offrendo un'esperienza di gioco dinamica e coinvolgente. Questo bookmaker, rinomato per le sue quote competitive e promozioni attraenti, si impegna a mantenere elevati standard di qualità e divertimento.

| Bookmaker | www.admiralbet.it |

| Bonus | 100% per primi depositi fino a 500€ |

| Condizioni | x8 volte l'importo |

| Descrizione | AdmiralBet, ex AdmiralYes, offre scommesse sportive con quote competitive e promozioni. Interfaccia intuitiva per desktop e mobile, bonus di benvenuto generoso e assistenza clienti dedicata lo rendono una scelta solida nel gaming online. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n.15096 |

| Minimo Deposito | 20€ |

| Massimo deposito | 10.000€ |

Pro

- Bonus benvenuto elevato (fino a 1000€).

- Bonus sportivo facile da sbloccare.

- Interfaccia intuitiva su PC e mobile.

- Ampia varietà di mercati scommesse.

Contro

- Mancanza del cash out.

La piattaforma si distingue per la sua interfaccia intuitiva, ottimizzata sia per desktop che per mobile, permettendo un accesso facile e veloce a un'ampia gamma di scommesse sportive. Il sito propone una varietà di mercati scommesse, coprendo eventi sportivi nazionali e internazionali, accattivando sia principianti che scommettitori esperti.

Il punto di forza di AdmiralBet è il suo bonus di benvenuto generoso, ideale per chi si avvicina per la prima volta al mondo delle scommesse. Inoltre, il bookmaker offre promozioni periodiche, che aggiungono un ulteriore livello di eccitazione al gioco.

L'assistenza clienti di AdmiralBet è un altro aspetto degno di nota. Il servizio di supporto è dedicato, efficiente e sempre disponibile per risolvere qualsiasi dubbio o problematica, garantendo una esperienza utente positiva e sicura.

Sisal.it, un rinomato operatore di betting online in Italia, vanta una storia significativa sia nel betting online che nei bet point fisici. Fondato nel 1946, si distingue come leader nel gioco d'azzardo italiano. Con un'interfaccia semplice e intuitiva, Sisal.it offre un'ampia gamma di giochi, inclusi scommesse sportive, poker, giochi di carte, slot e lotterie.

| Bookmaker | www.sisal.it |

| Bonus | 5.000€ subito e fino a 600€ di bonus di benvenuto |

| Condizioni | X10 volte l'importo |

| Descrizione | Sisal.it, leader nel betting online e giochi d'azzardo, offre un'esperienza utente intuitiva con un'ampia gamma di giochi, bonus generosi e un'impeccabile sicurezza ADM. Ideale per scommesse sportive e giochi mobili. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD: 15155 |

| Minimo Deposito | 10€ |

| Massimo deposito | 40€ |

Pro

- Incentivo Iniziale: Il bonus di benvenuto fornisce un incentivo immediato, come il bonus alla convalida del documento, che è un ottimo stimolo per i nuovi utenti.

- Distribuzione nel Tempo: Il bonus si sviluppa su un lungo periodo (fino a 55 settimane), promuovendo la fedeltà degli utenti e incoraggiando l'attività regolare sul sito.

- Versatilità: Il bonus è utilizzabile in diverse sezioni del sito, come scommesse sportive, ecc... offrendo una varietà di opzioni di gioco.

Contro

- Complessità dei Termini: I termini e le condizioni del bonus possono essere complessi e richiedere un'attenta lettura per essere completamente compresi.

- Requisiti di Scommessa: I bonus sono spesso soggetti a requisiti di scommessa specifici prima di poter prelevare le vincite, il che può limitare l'accessibilità dei fondi bonus per alcuni giocatori.

- Limitazione Temporale: Il bonus è distribuito in un lungo periodo, il che potrebbe non essere ideale per giocatori che cercano benefici immediati e consistenti.

La registrazione su Sisal.it è facile e sicura, con un'impeccabile conformità agli standard di legalità e sicurezza ADM. L'offerta di bonus, come il bonus di benvenuto fino a 315€, attira nuovi utenti, offrendo vantaggi tangibili per iscrizioni e depositi.

La sezione scommesse online di Sisal.it è rinomata per la sua chiarezza e facilità d'uso, con opzioni di scommesse live e una varietà di sport disponibili. Le applicazioni mobile per iOS e Android ampliano la convenienza, permettendo ai giocatori di scommettere in movimento.

In termini di sicurezza, Sisal.it eccelle con software Playtech e database sicuri e criptati, garantendo un ambiente di gioco affidabile. Il servizio clienti è accessibile e fornisce assistenza completa.

In conclusione, Sisal.it rappresenta un'opzione eccellente per gioco responsabile e divertimento nel mondo del betting online.

Lottomatica è un'ottima piattaforma per le scommesse online, offrendo ai giocatori un bonus di benvenuto allettante e un'ampia varietà di opzioni sportive.

| Bookmaker | www.lottomatica.it |

| Bonus | 100% dell’importo del primo deposito fino a 500€ |

| Condizioni | x6 volte l'importo |

| Descrizione | Lottomatica offre un ambiente di scommesse eccezionale con un bonus invitante e una vasta gamma di opzioni sportive. La registrazione veloce, insieme a bonus ricorrenti, rende l'esperienza coinvolgente: è una piattaforma affidabile nel panorama delle scommesse italiane. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n° 15017 |

| Minimo Deposito | 20€ |

| Massimo deposito | 500€ |

Pro

- Lottomatica si distingue per una serie di vantaggi che rendono l'esperienza di scommessa coinvolgente e completa. Grazie a bonus regolari e incentivi di fidelizzazione, come il bonus prima scommessa e offerte specifiche per determinati sport, i giocatori godono di opportunità continue per aumentare le loro vincite.

- La piattaforma offre una vasta varietà di opzioni sportive, abbracciando un ampio spettro di eventi come calcio, tennis, basket e molte altre discipline. Questa diversità permette agli appassionati di scommesse di trovare sempre qualcosa su cui puntare.

- Inoltre, Lottomatica offre un servizio di live streaming degli eventi sportivi, consentendo agli utenti di seguire le partite in tempo reale direttamente dalla piattaforma. Questo arricchisce l'esperienza di scommessa, offrendo un coinvolgimento immediato e coinvolgente.

- La combinazione di bonus allettanti, una vasta scelta di opzioni sportive e la possibilità di godere di live streaming rendono Lottomatica una scelta eccellente per gli amanti delle scommesse online in cerca di un'esperienza completa e coinvolgente.

Contro

- Lottomatica potrebbe presentare requisiti di scommessa rigidi che devono essere soddisfatti prima di prelevare le vincite ottenute attraverso il bonus.

- Inoltre, i tempi di elaborazione dei pagamenti potrebbero variare considerevolmente a seconda del metodo di prelievo scelto, causando possibili ritardi che potrebbero influenzare l'esperienza degli utenti.

- Alcuni utenti potrebbero riscontrare possibili problemi nella navigazione del sito, specialmente nell'individuare rapidamente le sezioni desiderate o nell'esperienza mobile, influenzando la facilità di utilizzo e l'accessibilità.

La registrazione rapida, unita a bonus regolari, rende l'esperienza coinvolgente per gli utenti. La piattaforma si distingue per la sua sicurezza avanzata e l'attenzione alla privacy dei giocatori, garantendo un ambiente sicuro e legale.

La sezione Better offre un palinsesto sportivo ricco, con possibilità di scommettere su una vasta gamma di eventi, tra cui calcio, tennis, basket e molte altre discipline. Il servizio di live streaming è un punto forte, offrendo agli utenti la possibilità di seguire gli eventi in tempo reale, mentre l'app mobile garantisce un'esperienza di scommessa fluida e accessibile da dispositivi mobili.

I pagamenti e i prelievi sono gestiti in modo versatile, consentendo l'utilizzo di diverse opzioni come Visa, PayPal e altre piattaforme, offrendo una maggiore flessibilità agli utenti. Il servizio clienti è attivo e accessibile attraverso vari canali, garantendo un supporto efficace.

In conclusione, Lottomatica si conferma come una delle migliori piattaforme nel panorama delle scommesse online in Italia, offrendo un'esperienza soddisfacente, affidabile e sicura per gli appassionati di betting.

GoldBet è un rinomato bookmaker italiano che si distingue per la sua affidabilità e la vasta offerta di servizi, inclusi scommesse sportive e lotterie. La piattaforma supporta numerosi sport per le scommesse, tra cui calcio, tennis, basket, automobilismo e molti altri, offrendo la possibilità di puntare su una vasta gamma di campionati.

| Bookmaker | www.goldbet.it |

| Bonus | 100% dell’importo del primo deposito fino a 500€ |

| Condizioni | x6 volte l'importo |

| Descrizione | GoldBet, rinomato bookmaker online, offre scommesse sportive. Con un'ampia selezione di eventi su cui scommettere e bonus generosi, include versione mobile, supporto clienti e gioco responsabile nel panorama nazionale. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n° 15226 |

| Minimo Deposito | 20€ |

| Massimo deposito | 500€ |

Pro

- GoldBet fornisce una vasta offerta di scommesse sportive, garantendo ampia scelta per l'intrattenimento dei giocatori.

- I generosi bonus e le promozioni regolari attraggono numerosi giocatori desiderosi di sfruttare vantaggi aggiuntivi durante il gioco.

- La piattaforma offre una versione mobile efficiente e un supporto clienti affidabile, garantendo un'esperienza di gioco completa e assistenza tempestiva ai suoi utenti.

Contro

- I requisiti di scommessa significativi sui bonus possono complicare il processo di prelievo delle vincite, richiedendo un volume di gioco considerevole prima di poter incassare.

- La piattaforma potrebbe essere soggetta a restrizioni geografiche o limitazioni di accesso, escludendo alcuni potenziali giocatori in specifiche regioni.

Playtech, uno dei migliori fornitori di software, gestisce i giochi, garantendo qualità e sicurezza. L'ampia offerta comprende giochi, slot machine, giochi di carte, bingo e lotterie. GoldBet offre promozioni e bonus interessanti, oltre a offerte per scommesse sportive e bingo.

La piattaforma si distingue anche per la sua versione mobile, permettendo di giocare comodamente da app. Registrarsi su GoldBet è semplice e richiede l'inserimento di informazioni personali e la verifica dell'identità. I metodi di pagamento variano tra carte di credito, portafogli elettronici e bonifici bancari.

Con una vasta selezione di promozioni per scommesse sportive, GoldBet è apprezzato anche per le scommesse live, consentendo ai giocatori di puntare su eventi in corso. L'assistenza clienti è disponibile tramite telefono, email e live chat. La piattaforma promuove il gioco responsabile e aderisce alle normative italiane sul gioco d'azzardo, garantendo sicurezza e affidabilità. GoldBet si posiziona come una delle migliori opzioni nel panorama nazionale dei bookmaker per la sua vastità di servizi e la sicurezza offerta ai giocatori.

SNAI è un leader nel settore del gioco d'azzardo in Italia, con una storia di affidabilità e innovazione. Fondata nel 1990, SNAI ha costantemente ridefinito l'esperienza di scommesse sportive, offrendo una vasta gamma di eventi sportivi, da calcio a tennis, passando per corse ippiche e molto altro ancora.

Uno dei punti di forza di SNAI è la sua piattaforma online, progettata per offrire un'esperienza utente intuitiva e coinvolgente. Gli utenti possono godere di una vasta selezione di quote competitive, promozioni esclusive e una varietà di metodi di pagamento sicuri.

| Bookmaker | www.snai.it |

| Bonus | 100% per primi depositi fino a 100€; 50% fino a 200€ per l’importo che eccede i 100€. |

| Condizioni | x8 volte l'importo |

| Descrizione | SNAI, leader nel gioco d'azzardo in Italia, unisce affidabilità e innovazione. La piattaforma online offre quote competitive, sicurezza e un servizio clienti dedicato. Integra tecnologie innovative per un'esperienza coinvolgente e rappresenta sicurezza, divertimento responsabile e innovazione nel settore. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n° 15215 |

| Minimo Deposito | 10€ |

| Massimo deposito | 500€ |

Pro

- SNAI offre una piattaforma ben organizzata e intuitiva, rendendo la navigazione e la fruizione dei servizi di scommesse sportive un'esperienza semplice e piacevole.

- Propone offerte promozionali e bonus competitivi per i nuovi iscritti, inclusi un generoso bonus di benvenuto e promozioni ricorrenti.

- Il servizio clienti di SNAI si distingue per la sua efficienza e professionalità, offrendo diverse modalità di contatto, tra cui chat, telefono e email.

Contro

- SNAI potrebbe presentare una selezione ristretta di metodi di pagamento e di prelievo rispetto ad altri operatori del settore.

- Nonostante i bonus generosi offerti, i requisiti per riscattare i bonus, come il playthrough richiesto entro un certo periodo, potrebbero risultare restrittivi per alcuni utenti. Ciò potrebbe richiedere un impegno maggiore da parte degli scommettitori per ottenere il pieno beneficio delle offerte promozionali.

- Alcuni utenti potrebbero desiderare una maggiore varietà di opzioni di gioco, come ad esempio scommesse su eventi non convenzionali o una più ampia selezione di giochi alternativi.

La trasparenza e la sicurezza sono al centro dell'approccio di SNAI, garantendo un ambiente di gioco responsabile e conforme alle normative vigenti. La piattaforma offre anche un servizio clienti dedicato, pronto a rispondere alle domande e alle esigenze degli utenti in ogni momento.

Inoltre, SNAI è all'avanguardia nell'integrazione di tecnologie innovative, come l'utilizzo di app mobili e streaming live per consentire agli scommettitori di vivere in tempo reale l'azione degli eventi sportivi e scommettere mentre guardano le partite.

In sintesi, SNAI rappresenta non solo una destinazione di riferimento per gli amanti delle scommesse, ma anche un marchio sinonimo di sicurezza, divertimento responsabile e innovazione nel mondo del gioco d'azzardo.

Se sei un appassionato di scommesse sportive, SNAI è la scelta ideale per un'esperienza di gioco coinvolgente e sicura.

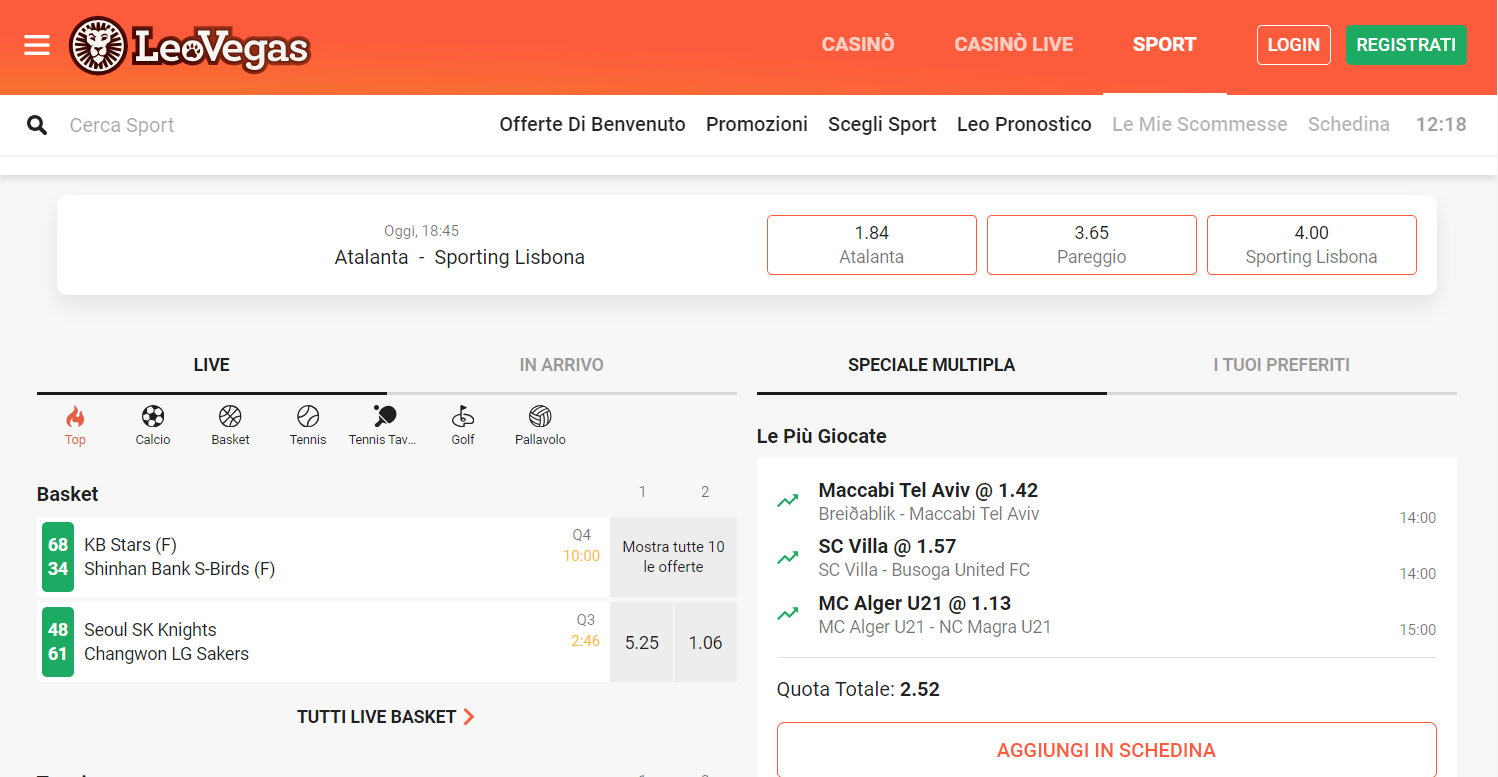

LeoVegas è un bookmaker emergente nel mercato italiano del betting online, offrendo un'esperienza di gioco sicura, semplice e affidabile. Il suo sito web si distingue per la semplicità dell'interfaccia e la facilità di navigazione, ideale sia per i giocatori esperti che per i neofiti. L'accesso immediato alla chat di assistenza clienti dalla home page assicura un supporto immediato per risolvere dubbi o problemi.

| Bookmaker | www.leovegas.it |

| Bonus | 50% per primi depositi fino a 100€ |

| Condizioni | x6 volte l'importo |

| Descrizione | LeoVegas, una nuova piattaforma nel mondo delle scommesse, si distingue per la sua semplicità e sicurezza. Con un'interfaccia user-friendly, un vasto palinsesto sportivo e un'efficiente assistenza clienti, offre un'esperienza di gioco affidabile e accessibile. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n° 15011 |

| Minimo Deposito | 10€ |

| Massimo deposito | 400€ |

Pro

- La semplicità rappresenta uno dei pilastri fondamentali: l'interfaccia intuitiva del sito consente una navigazione agevole, sia per i giocatori esperti che per i neofiti, assicurando un'esperienza utente gradevole e senza complicazioni.

- La varietà sportiva rappresenta un vantaggio significativo. Oltre alle scommesse sportive classiche come il calcio, il tennis o il basket, LeoVegas offre la possibilità di puntare su una vasta gamma di discipline sportive, dal pugilato all'hockey, dalla pallavolo ai giochi invernali.

- Un aspetto rilevante è l'ottimizzazione per mobile, che permette un accesso immediato alle scommesse sportive e ai giochi da casinò da dispositivi mobili.

Contro

- La mancanza di live streaming è uno dei principali punti deboli della piattaforma. Questa assenza potrebbe rappresentare una delusione per coloro che apprezzano questa funzionalità per vivere in diretta l'azione sportiva su cui stanno scommettendo.

- I tempi per i prelievi e i depositi, così come i limiti di transazione, possono variare a seconda del metodo scelto. Questo potrebbe causare disagio agli utenti che desiderano transazioni più rapide o che preferiscono limiti di transazione più flessibili.

- La mancanza di un supporto 24/7 potrebbe rappresentare un limite per coloro che necessitano di assistenza in orari non convenzionali o durante le ore serali.

LeoVegas presenta un vasto palinsesto sportivo che include calcio, pugilato, hockey, tennis e molti altri sport, sia pre-match che live, rispondendo alle esigenze degli scommettitori.

L'applicazione LeoVegas è disponibile sia su Apple Store che su Google Play, offrendo accesso alle scommesse sportive e ai giochi del casinò, mentre il sito mobile è ottimizzato per una navigazione fluida.

Per quanto riguarda il sito online, LeoVegas presenta una vasta gamma di giochi con licenza AAMS, tra cui roulette, blackjack e oltre 100 slot diverse, con promozioni e jackpot interessanti.

L'assistenza clienti è accessibile tramite live chat, numero di telefono e e-mail, garantendo un supporto tempestivo agli utenti.

Planetwin365 è una piattaforma di gioco online fondata nel 2009, offrendo una vasta gamma di servizi di scommesse sportive, scratch, poker e giochi virtuali. Gestita dal gruppo SKS365, la piattaforma ha guadagnato popolarità grazie alla sua varietà di opzioni di scommessa su eventi sportivi internazionali, compresi calcio, tennis, basket e altro ancora.

La piattaforma offre un'interfaccia user-friendly accessibile sia da desktop che da dispositivi mobili, consentendo agli utenti di scommettere in tempo reale su una vasta gamma di eventi sportivi. Il sito online presenta giochi come slot machine, roulette, blackjack e altro ancora, offrendo un'esperienza di gioco completa agli utenti.

| Bookmaker | www.planetwin365.it |

| Bonus | 50% dell'importo depositato fino a 365€ |

| Condizioni | x8 volte l'importo |

| Descrizione | Planetwin365, la piattaforma di gioco online del gruppo SKS365, offre scommesse sportive e giochi da casinò come slot machine e blackjack. Con un'interfaccia user-friendly e sicurezza avanzata, è un punto di riferimento per gli amanti delle scommesse online. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n.15242 |

| Minimo Deposito | 5€ |

| Massimo deposito | 215€ |

Pro

- Vasta offerta di servizi, includendo scommesse sportive, casinò, poker e giochi virtuali.

- Interfaccia intuitiva e user-friendly, sia su desktop che su dispositivi mobili.

- Servizio clienti efficiente, pronto ad assistere gli utenti in modo rapido e professionale in caso di domande o problemi.

- Reputazione consolidata per l'affidabilità e la sicurezza.

Contro

- L'applicazione mobile risulta poco ottimizzata per dispositivi come smartphone e tablet, limitando l'esperienza di gioco.

Planetwin365 si impegna per la sicurezza degli utenti, implementando protocolli di sicurezza avanzati per proteggere i dati personali e finanziari degli scommettitori. Inoltre, offre varie opzioni di pagamento per depositi e prelievi, garantendo transazioni sicure e veloci.

La piattaforma si distingue anche per il suo servizio clienti efficiente e disponibile, pronto ad assistere gli utenti in caso di domande o problemi. Con una vasta offerta di scommesse e giochi, insieme a un'impeccabile reputazione per l'affidabilità e la sicurezza, Planetwin365 continua a essere una delle piattaforme preferite per gli amanti del gioco d'azzardo online.

Siti di Scommesse con Bonus Attraenti

Nel mondo delle scommesse, i bonus giocano un ruolo cruciale nell'attrarre nuovi scommettitori e nel premiare la fedeltà degli utenti. In questo elenco, esploreremo attentamente i siti che si distinguono per i loro bonus generosi e le promozioni interessanti per le tue giocate.

BetFlag, piattaforma italiana di scommesse e giochi online, offre bonus vantaggiosi e supporta il Betting Exchange. Con un'ottima App, la piattaforma è legale, sicura e dotata di una vasta offerta di scommesse sportive e giochi da casinò.

| Bonus | Descrizione e Condizioni necessarie |

| Multipla imbattibile | Requisiti chiave: - Partecipare a scommesse multiple prima dell'inizio degli incontri di calcio selezionati. - Scommettere su una varietà di opzioni (esito finale 1X2, under/over 2,5, 1X2 handicap) - Includere da 3 a 30 eventi nella tua multipla imbattibile. L'incremento della vincita verrà mostrato in tempo reale. |

| Fino al 500% di incremento vincita | Requisiti chiave: - Giocare scommesse multiple pre-match + live. - Scommettere su qualsiasi opzione, escludendo solo il mercato "marcatore sì/no". - Includere da 2 a 30 eventi nelle tue multiple. |

| 100% di rimborso dell'importo "Giocato - Vincite" | Puoi convertire fino al 100% delle giocate non vincenti. Requisiti chiave: - Effettuare scommesse sugli eventi nel PALINSESTO PROMO 100%. - Rigiocare il bonus due volte prima del prelievo. - La quota minima per le scommesse è di 2.00. Il bonus verrà accreditato alle 09:00 del giorno successivo alla promozione; scade entro le 23:59 del giorno di assegnazione. La promozione è valida solo il martedì, il giovedì e il sabato. |

Eurobet, fondata nel 1996, è un leader nel settore delle scommesse con promozioni frequenti, ampia offerta di eventi, servizio clienti di qualità e alta sicurezza finanziaria.

| Bonus | Descrizione e Condizioni necessarie |

| ReadyBet | Non sai quale combinazione scegliere per la tua Multipla? Scopri tutte le proposte, basta un click. Più precompilate per tante opportunità: facili, veloci, pronte. Requisiti chiave: - Naviga la vasta selezione di proposte pronte per te con un semplice clic. - Selezionare la ReadyBet e cliccare su Gioca 2€ e vinci xxx€. - Scegliere l'importo da scommettere per iniziare a giocare. |

| Marcatore Tandem | Prevedi chi segnerà almeno un goal nel prossimo match. Requisiti chiave: - Scegliere se un calciatore o il suo sostituto segnerà almeno un gol nei tempi regolamentari. - Se il giocatore selezionato o il suo sostituto segna, la scommessa è vincente. - Se il giocatore è assente e non giocherà, l'importo scommesso verrà rimborsato. - Disponibile per gli incontri di Calcio Serie A e Coppe Europee. |

| Bonus Multiple | Gioca scommesse multiple con almeno 5 eventi e aumenta le tue vincite progressivamente. Requisiti chiave: - La quota minima deve essere di 1.25. - Il bonus può crescere fino al 144,6% per un massimo di 30 eventi validi. - Il limite massimo del bonus è di 50.000€. - Tutti gli eventi selezionati devono essere programmati entro 7 giorni dalla scommessa per attivare il bonus. - Le giocate sistemiche non rientrano nel calcolo del bonus. |

StarCasinò Scommesse, il leader nel gioco d'azzardo online in Italia, offre una piattaforma sicura e coinvolgente. Con un'ampia selezione di giochi da casinò, scommesse sportive e bonus invitanti, è la scelta perfetta per i giocatori entusiasti.

| Bonus | Descrizione e Condizioni necessarie |

| Bonus Multipla | Scommetti su 5 eventi con una quota minima di 1,25 per aumentare la tua vincita fino al 300%. Requisiti chiave: - Se un evento nella multipla diventa nullo, il bonus si calcola su un evento in meno. - Se anche solo un evento ha data/ora oltre un mese dalla scommessa, il bonus viene azzerato. - Le scommesse a sistema non vengono calcolate per il bonus. - Il bonus è parte integrante della vincita totale, limitata a 10.000€. |

| Quota 100 | Ogni martedì e venerdì, puoi ottenere un rimborso fino a 100€ sulle tue multiple a quota 100. Requisiti chiave: - Effettuare una scommessa multipla di almeno 5€ contenente almeno 10 eventi. - La quota minima complessiva della scommessa deve essere pari o superiore a 100.00. - Il rimborso si applica in caso di mancata vincita dovuta a uno o tutti gli eventi in schedina. - Si considera valida solo la prima scommessa qualificante di ciascun giorno della promozione. |

| Serata Sport Live | Ogni mercoledì e domenica, puoi ottenere un rimborso fino a 20€ sulle tue scommesse Live. Requisiti chiave: - Effettuare 3 o più scommesse live, ciascuna di almeno 10€, con una quota minima totale di almeno 2.00. - In caso di mancata vincita, riceverai un rimborso del 10% fino a un massimo di 20€. - Il rimborso sarà calcolato sulla perdita netta, cioè sull'importo scommesso complessivo meno l'importo vinto complessivo. |

Questi siti selezionati offrono alcuni dei bonus più allettanti disponibili nel panorama delle scommesse, rendendo l'esperienza di scommessa ancora più gratificante e stimolante.

Migliori Siti di Scommesse con Bonus Senza Deposito in Italia

I bonus senza deposito sono particolarmente apprezzati dagli scommettitori italiani, poiché permettono di iniziare a scommettere senza necessità di un deposito iniziale. Scopriamo quali sono le migliori opzioni disponibili.

BetItaly è una piattaforma italiana di betting online con grafica accattivante e promozioni aggiornate. Offre un'iscrizione semplice e sicura, bonus multiple, app mobile e ampia scelta di scommesse sportive, configurandosi come un'opzione valida per chi predilige il gioco italiano.

| Bonus Senza Deposito | Descrizione e Condizioni necessarie |

| E-Coupon 5€ | - Vale per sette giorni dalla data di erogazione. - Può essere usato per una o più scommesse sportive pre-match con almeno 7 eventi. - Non è possibile utilizzare l'E-Coupon per scommesse live o scommesse sistemistiche. - Le vincite generate tramite E-Coupon possono essere prelevate dal conto. |

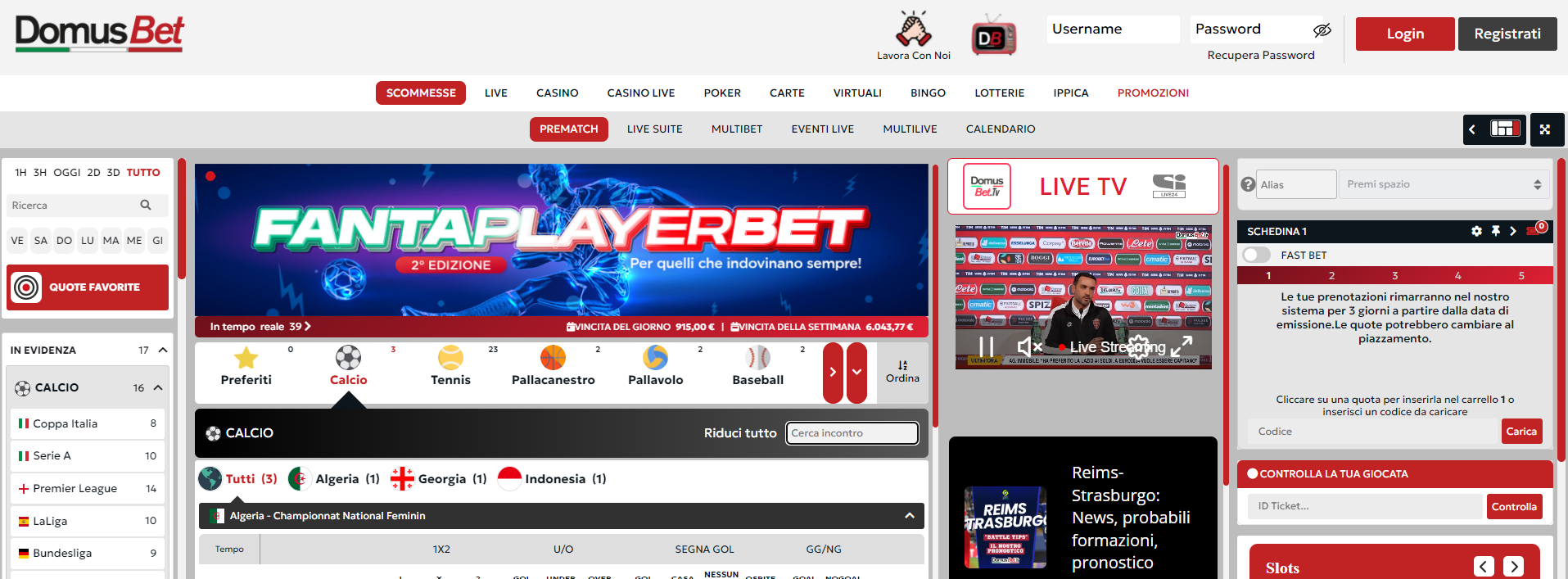

DomusBet, rinomato bookmaker italiano con licenza ADM, offre scommesse sportive. Con grafica intuitiva, bonus notevoli e varietà sportiva, offre un'a pp mobile ottima e pagamenti sicuri.

| Bonus Senza Deposito | Descrizione e Condizioni necessarie |

| Fun Bonus Sport 10€ | - Può essere utilizzato per piazzare scommesse sportive che includano almeno 3 eventi, con una quota singola minima di 1.70 e una quota totale non inferiore a 5. - Per convertirlo in Real Bonus, è necessario scommetterlo 6 volte il suo valore. - Eventuali vincite ottenute utilizzando il Fun Bonus saranno accreditate come Real Bonus. |

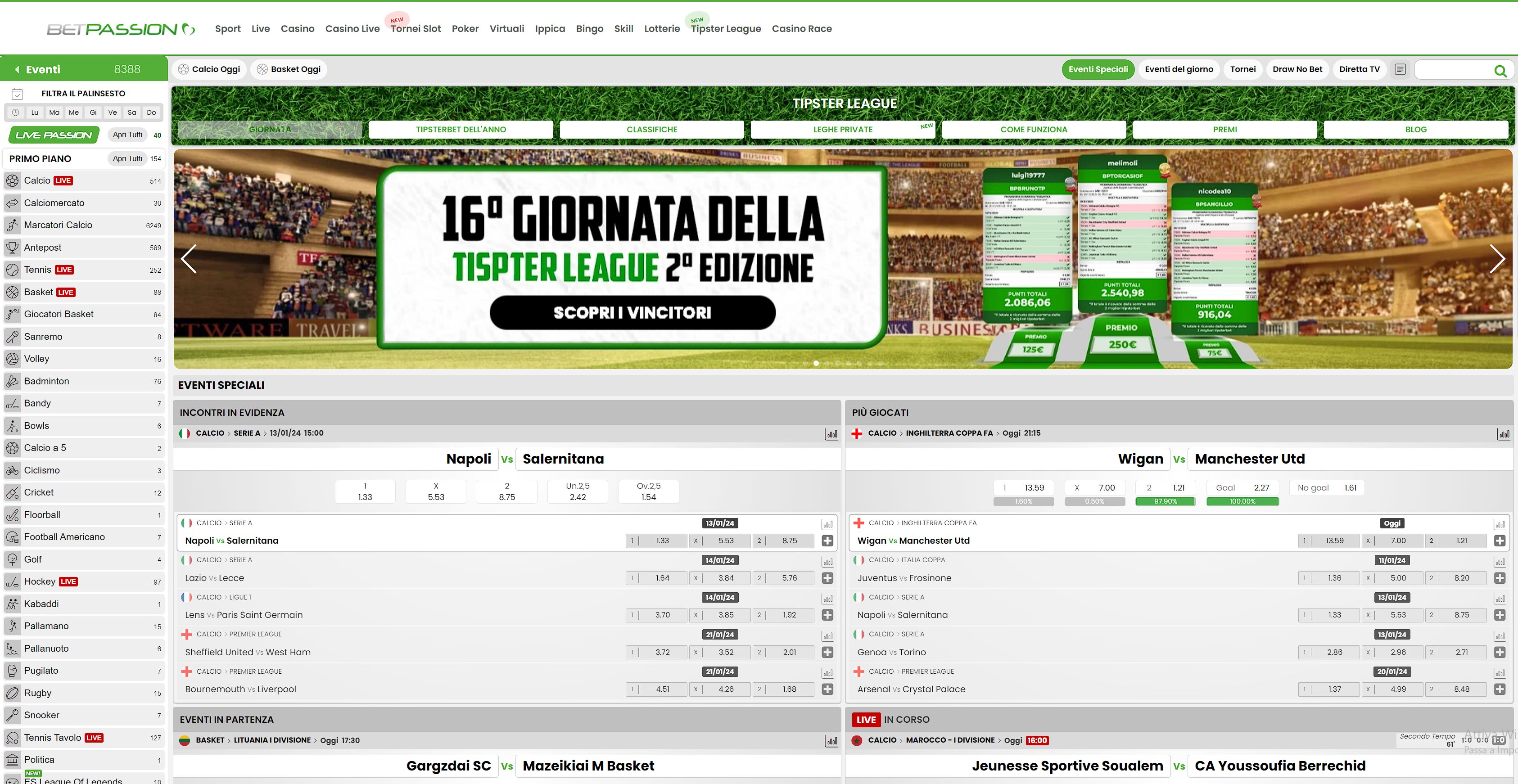

Betpassion è un rinomato bookmaker online con un'ampia selezione di scommesse sportive. Offre bonus generosi, supporto efficiente e sicurezza garantita con licenza ADM.

| Bonus Senza Deposito | Descrizione e Condizioni necessarie |

| Bonus Giocatore Attivo | - Ogni cliente registrato riceverà un premio giornaliero di 20 euro prorogabile fino a 7 giorni. - Il premio può essere sbloccato solo completando la missione associata. - Nel corso della settimana, i giocatori più attivi potranno ricevere un totale di 140 euro come bonus senza deposito (20€ x 7 giorni). |

Sfruttando queste offerte, potrai esplorare le piattaforme di scommesse senza rischi finanziari iniziali, avendo l'opportunità di familiarizzare con l'interfaccia e l'ambiente di scommessa offerto dai siti raccomandati.

Siti di scommesse legali in Italia

Benvenuto nella selezione di siti di scommesse legali, autorizzati e regolamentati in Italia. È essenziale che gli scommettitori operino su piattaforme conformi alle leggi e ai regolamenti del Paese.

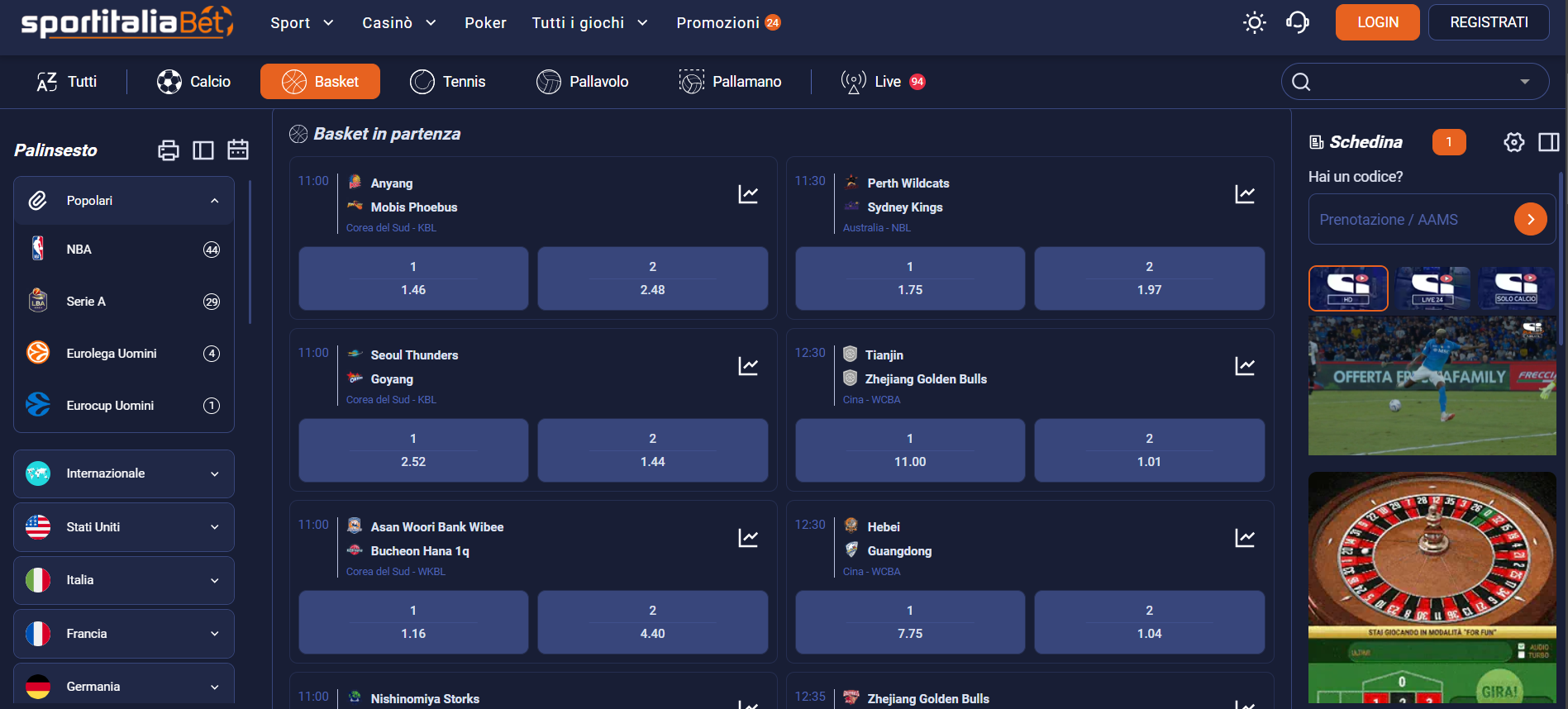

SportitaliaBet è una piattaforma di scommesse e giochi online gestita da E-PLAY24 ITA LTD. Detiene l'unica licenza ADM per il gioco legale in Italia, garantendo sicurezza e conformità alle normative. La homepage offre navigabilità intuitiva e un'ampia gamma di opzioni, tra scommesse sportive, ippica, e altro.

| Bookmaker | www.sportitaliabet.it |

| Bonus | 100% dell'importo depositato fino a 50€ |

| Condizioni | x1 volta l'importo |

| Descrizione | SportitaliaBet offre ampia scelta di scommesse sportive, bonus di benvenuto, promozioni speciali, scommesse live, supporto clienti italiano e sicurezza crittografica. Esperienza completa e variegata per gli appassionati del gioco online. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n. 15232 |

| Minimo Deposito | 10€ |

| Massimo deposito | 50€ |

Pro

- L'impegno per la sicurezza crittografica e il rispetto della privacy dei giocatori rafforzano la fiducia nella piattaforma.

- Vasta gamma di opzioni di scommessa sportiva: abbraccia non solo gli sport più popolari come calcio, tennis e basket ma anche discipline minori come sci alpino, cricket e curling.

- Diversificazione dell'offerta di giochi: SportitaliaBet offre un ricco catalogo di scommesse online, slot machine, poker e altro ancora.

- La modalità di scommesse live offre un'esperienza coinvolgente.

Contro

- Il bonus di benvenuto, sebbene presente, potrebbe risultare inferiore rispetto ad altre piattaforme concorrenti.

- La mancanza di un'app mobile dedicata può rappresentare un limite.

La piattaforma offre scommesse su vari sport, con dati in tempo reale e statistiche dettagliate. La sezione live consente scommesse in tempo reale durante gli eventi sportivi.

Nonostante l'assenza di un'app dedicata, il sito è adattabile a diversi dispositivi. Oltre alle scommesse, la sezione gioco offre una vasta selezione di giochi, inclusi titoli live.

La sicurezza è garantita da crittografia avanzata e conformità alle leggi antiriciclaggio. In conclusione, SportitaliaBet offre un'esperienza completa per scommesse e giochi online, con varie opzioni, bonus e un solido supporto clienti in italiano.

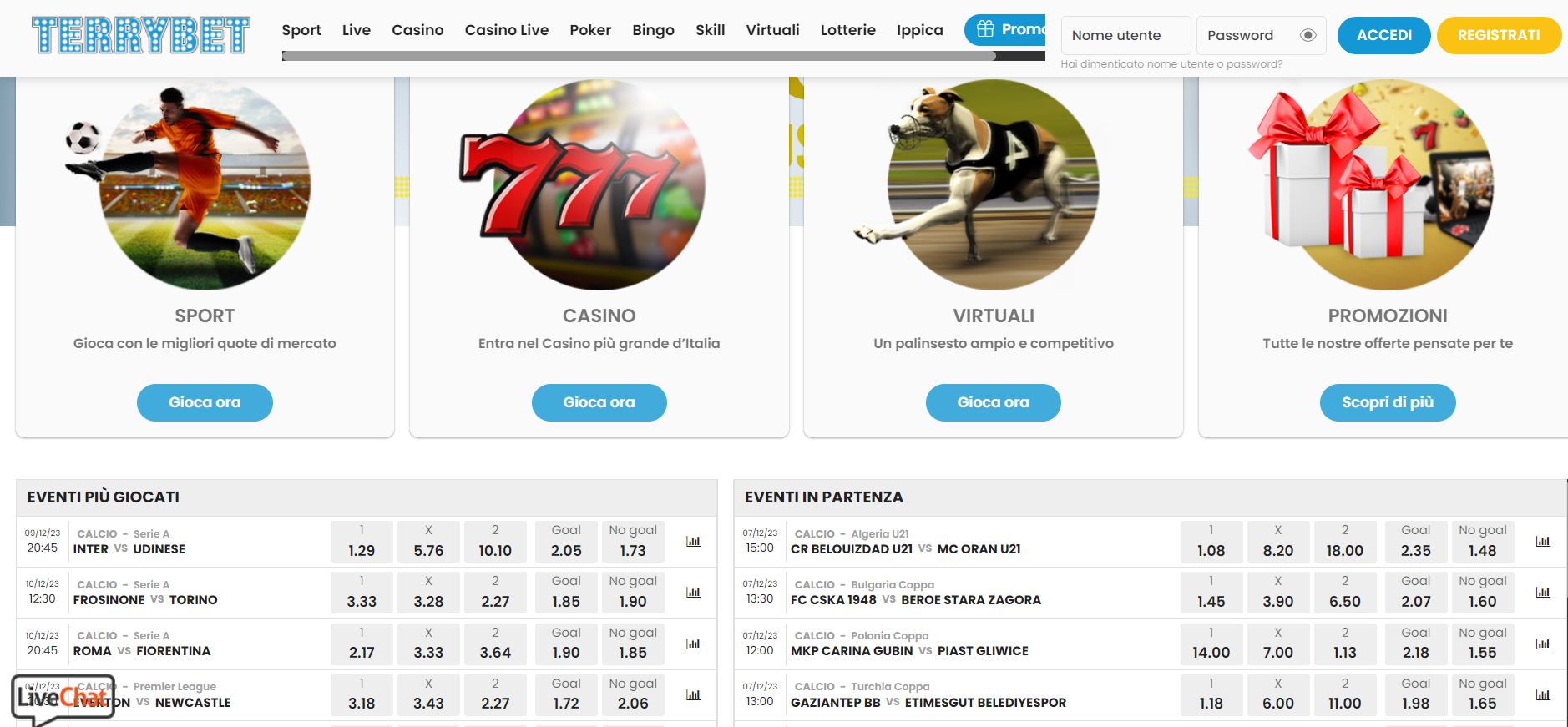

Terrybet è una realtà consolidata nel mondo del gioco d'azzardo online. Operante dal 2011, si distingue come una piattaforma di gioco affidabile e completa. La gestione della piattaforma è affidata a Microgame, un leader nei servizi di gioco d'azzardo con una solida esperienza sin dal 1996.

| Bookmaker | www.terrybet.it |

| Bonus | 50% dell'importo depositato fino a 25€ |

| Condizioni | x5 volte l'importo |

| Descrizione | Terrybet, gestito da Street Web S.r.l., offre gioco d'azzardo online dal 2011 con ampia gamma di servizi, inclusi poker e lotterie. Vanta una licenza AAMS/ADM per garantire un'esperienza sicura. |

| Paese | Italia |

| Licenza | ADM |

| N. Licenza | GAD n.15245 |

| Minimo Deposito | 10€ |

| Massimo deposito | 25€ |

Pro

- App mobile di alta qualità.

- Assistenza tramite WhatsApp.

- Spin gratuiti giornalieri.

- Vasta selezione di giochi innovativi.

- Depositi istantanei.

Contro

- Requisiti di puntata impegnativi.

- Massimale bonus non elevato.

Il marchio Terrybet è di proprietà di Street Web S.r.l., che possiede anche diverse altre piattaforme di gioco e detiene la concessione GAD n.15245. Recentemente, l'operatore ha espanso la sua presenza attraverso la rete di vendita fisica in tutto il territorio nazionale. L'offerta di Terrybet comprende servizi di poker, lotterie e Gratta e Vinci, contribuendo a posizionarlo tra le realtà più interessanti del settore.

Sebbene Street Web S.r.l. non abbia ancora espanso la sua presenza al di fuori dell'Italia, sembra essersi preparata per future espansioni. Con una solida base aziendale e un focus sulla qualità e l'affidabilità dei servizi offerti, Terrybet è una scelta interessante per gli appassionati di gioco d'azzardo online. La piattaforma è autorizzata e regolamentata dalla licenza AAMS/ADM, garantendo un'esperienza di gioco sicura e divertente per gli utenti.

Questi siti Web selezionati sono stati scelti con cura per la loro conformità alle leggi e ai regolamenti in Italia, garantendo un ambiente di scommesse sicuro e affidabile per gli utenti.

Operare su piattaforme legali offre agli scommettitori maggiore sicurezza e trasparenza nelle transazioni, garantendo che le loro scommesse avvengano entro i limiti di legge. Se sei interessato nel conoscere altri bookmaker ti consiglio di dare un'occhiata alla guida ai siti scommesse non aams.

Alla Scoperta dei Bookmakers online che sono legali in Italia

Da appassionato italiano di scommesse, desidero condividere con voi la mia esperienza.

Immergersi nel mondo delle scommesse online in Italia offre un'esperienza affascinante. Il settore, regolato con precisione, apre le porte a numerose opportunità per chi, come noi, è appassionato di questo tipo di intrattenimento. Ho esplorato personalmente il panorama italiano per scoprire e valutare i migliori siti di scommesse che accolgono giocatori nostrani, ciascuno con i suoi allettanti bonus di benvenuto.

Se siete interessati a scoprire di più sulle scommesse online in Italia e desiderate conoscere le mie esperienze in questi siti, vi invito a seguire il mio racconto.

Come Valutare i Siti di Scommesse online?

Nel valutare i siti di scommesse, una serie di criteri cruciali determinano la qualità complessiva dell'esperienza offerta agli scommettitori. Esploriamo attentamente ciascun elemento fondamentale che caratterizza la valutazione dei migliori siti di scommesse:

- Offerta di Eventi Sportivi: Valutiamo attentamente la diversità e la completezza dell'offerta di eventi sportivi offerti dai siti di scommesse. Dalla copertura di sport popolari a eventi di nicchia, cerchiamo siti che offrano una vasta gamma di opzioni per gli appassionati dello sport.

- Quote: Analizziamo con cura le quote proposte dai diversi bookmaker. La precisione e la competitività delle quote sono fondamentali per gli scommettitori, quindi valutiamo la coerenza e l'attrattiva delle stesse offerte.

- Bonus e Promozioni: Consideriamo i bonus di benvenuto, le promozioni periodiche e le offerte speciali fornite dai siti di scommesse. Cerchiamo di individuare le offerte più generose e vantaggiose per gli utenti.

- Offerta di Scommesse Live: Valutiamo la qualità e la varietà delle opzioni di scommesse live offerte dai bookmaker. Questa modalità di scommessa in tempo reale è sempre più popolare, quindi cerchiamo siti che offrano un'ampia scelta di eventi live e opzioni di scommessa.

- Applicazioni Mobili: L'usabilità, le funzionalità e l'efficienza delle app mobili fornite dai siti di scommesse sono importanti per noi. Un'esperienza mobile ottimale è cruciale per gli scommettitori che desiderano una piattaforma comoda e accessibile da dispositivi portatili.

- Metodi di Pagamento: Teniamo conto della varietà dei metodi di pagamento disponibili e l'efficienza delle transazioni finanziarie. La presenza di opzioni di pagamento sicure e convenienti è fondamentale per garantire una buona esperienza agli utenti.

- Piattaforma e Usabilità: Esaminiamo l'interfaccia utente, la facilità di navigazione e l'esperienza complessiva offerta dalla piattaforma di scommesse. Cerchiamo siti con un'usabilità intuitiva e una piattaforma ben progettata.

- Sicurezza e Licenze: La sicurezza dei dati e la presenza di licenze regolamentate sono aspetti cruciali. Valutiamo la conformità normativa e le misure di sicurezza adottate dai siti di scommesse per garantire un ambiente affidabile e protetto per gli utenti.

- Servizio Clienti: Esaminiamo la qualità del servizio clienti offerto, valutando la prontezza nel rispondere alle domande degli utenti, l'efficacia nel risolvere i problemi e la disponibilità di diverse opzioni di contatto per assistere gli scommettitori.

Questa valutazione dettagliata mira a identificare e raccomandare le piattaforme che offrono una combinazione ideale di funzionalità, affidabilità e vantaggi per gli appassionati di scommesse sportive.

Quali sono gli venti dove posso scommettere on line legalmente in Italia?

In Italia, il gioco d'azzardo online è regolamentato e ci sono diversi tipi di eventi su cui puoi scommettere legalmente. Ecco un'analisi breve per ogni categoria:

- Scommesse Calcio: Il calcio è lo sport più popolare per le scommesse in Italia. Puoi scommettere su vari aspetti come il risultato della partita, il numero di gol, i marcatori e molto altro. Le competizioni includono serie nazionali (Serie A, Serie B), coppe nazionali (Coppa Italia) e tornei internazionali (Champions League, Europa League, Mondiali, Europei).

- Scommesse Basket: Il basket offre opportunità di scommesse su partite nazionali (Legabasket Serie A) e internazionali (NBA, Euroleague). Le scommesse possono riguardare il vincitore della partita, il punteggio totale, differenze di punteggio, e performance individuali dei giocatori.

- Scommesse Tennis: Nel tennis, le scommesse includono tornei del Grande Slam, ATP, WTA, e altri eventi minori. Le opzioni di scommessa variano dal vincitore del match e del torneo, al numero di set e giochi, fino a scommesse più specifiche come il numero di ace.

- Scommesse Ciclismo: Le scommesse sul ciclismo si concentrano su eventi come il Giro d'Italia, Tour de France e la Vuelta a España. Puoi scommettere sul vincitore della gara, delle singole tappe, o su classifiche specifiche come la maglia a pois o la maglia verde.

- Scommesse Motori: Include Formula 1, MotoGP, e rally. Le scommesse possono essere sul vincitore di gare singole, sul campione del mondo, o su eventi specifici della gara come il pilota con il giro più veloce.

- Scommesse Speciali: Questa categoria è molto varia e include eventi come elezioni politiche, reality show, concorsi di cucina, e altri eventi non sportivi. Le scommesse dipendono dalla natura dell'evento, come il vincitore di un reality show o il risultato di un'elezione.

- Scommesse Esports: Una categoria in rapida crescita che include videogiochi competitivi come League of Legends, CS:GO, e Dota 2. Le scommesse riguardano il vincitore di partite e tornei, oltre a specifiche del gioco come il primo sangue o il numero di uccisioni.

Ciascuna di queste categorie offre un'esperienza di scommessa unica, con diverse strategie e tipi di scommesse. È importante scommettere in modo responsabile e solo su siti con licenza ADM per garantire gioco sicuro e legale.

Alternative alle scommesse convenzionali in Italia:

Scoprite le Guide alle Scommesse più Complete per Vincere nel Gioco Online

Carissimi lettori, benvenuti nella sezione dedicata alle guide alle scommesse! Qui troverete tutto ciò che vi serve per navigare con sicurezza e strategia nel mondo delle scommesse online in Italia. Ecco una panoramica dei tipi di scommesse che approfondiremo insieme:

- Scommesse Live: Le scommesse live sono un'emozionante forma di gioco che permette di puntare su eventi sportivi in tempo reale. Nelle nostre guide, scoprirete come cogliere le migliori opportunità che si presentano durante il corso di una partita, analizzando dinamiche di gioco e quote in continuo aggiornamento. Vi insegneremo a interpretare l'andamento del gioco e a prendere decisioni rapide per massimizzare le vostre vincite.

- Scommesse Virtuali: Nel mondo delle scommesse virtuali, gli eventi sportivi sono simulati da software avanzati. Questo tipo di scommessa offre la possibilità di puntare in qualsiasi momento, senza dover attendere eventi reali. Le nostre guide vi forniranno una comprensione approfondita di come funzionano queste scommesse, le strategie da adottare e come gestire al meglio le vostre risorse in questo ambiente digitale.

In ognuna di queste sezioni, troverete consigli esperti, tecniche avanzate e tutto ciò che c'è da sapere per fare delle vostre scommesse un vero e proprio investimento nel divertimento e nella possibilità di vincita. Restate con noi per diventare maestri nel mondo delle scommesse online!

La Mia Esperienza con la Regolamentazione dei Siti di Scommesse in Italia

Nella mia carriera nel mondo delle scommesse online, ho avuto l'opportunità di esplorare diverse normative a livello internazionale. Oggi vorrei condividere con voi le mie osservazioni sulla situazione in Italia, un paese noto per la sua regolamentazione attenta nel settore del gioco d'azzardo.

È Legale Scommettere Online in Italia?

Molti si chiedono se sia legale scommettere online in Italia. La risposta è positiva, ma con alcune restrizioni. Con l'introduzione di normative specifiche come l'AAMS (ora ADM), il governo italiano ha iniziato a regolamentare strettamente l'accesso ai siti di scommesse, assicurando che operino in conformità con le leggi nazionali. Questo significa che i giocatori italiani hanno accesso a un'ampia gamma di siti legali e sicuri. Ti consiglio di dare un'occhiata alla lista dei migliori casino non AAMS per capire la differenza.

Quali Bookmakers Sono Disponibili in Italia?

Nonostante le restrizioni, in Italia esistono diverse opzioni per scommettere online. Molti siti disponibili sono autorizzati dall'ADM e offrono un'ampia gamma di scommesse. Ecco alcuni esempi che ho trovato interessanti:

- Snai - Con licenza ADM.

- Bet365 e Unibet - Entrambi con licenze ADM.

- William Hill - Anche con una licenza ADM, molto popolare tra gli scommettitori.

- Altre opzioni come Eurobet, Bwin, Sisal, e Lottomatica, tutte con licenze riconosciute in Italia.

Come Scegliere il Migliore Sito di Scommesse in Italia?

Nella mia esperienza, la scelta di un sito di scommesse in un mercato regolamentato come quello italiano richiede attenzione a diversi fattori:

- Accettazione di Giocatori Italiani: È fondamentale che il sito accetti giocatori dall'Italia.

- Qualità del Sito: Verificare le offerte sportive, tipologie di scommesse, funzionalità speciali come live streaming e cash out, oltre a una grafica user-friendly e app per dispositivi mobili.

- Bonus e Promozioni: Optare per siti che offrono bonus di benvenuto vantaggiosi e promozioni periodiche.

- Metodi di Pagamento: Controllare la disponibilità di metodi di pagamento preferiti, inclusi carte di credito, PayPal, Postepay, e anche criptovalute.

Riflessione riguardo le scommesse sportive online in Italia

L'Italia, con la sua politica rigorosa, offre comunque opportunità interessanti per gli appassionati di scommesse online. Nella mia carriera, ho sempre trovato affascinante navigare tra le varie normative e scoprire come i diversi paesi gestiscono il gioco d'azzardo online. Spero che queste informazioni vi siano utili per esplorare il mondo delle scommesse online in Italia.

Strategie di Scommesse e Risorse

La sezione "Strategie di Scommesse e Risorse" è il vostro centro di comando per navigare con successo nel mondo delle scommesse. Qui troverete informazioni dettagliate e strumenti utili per affinare le vostre tecniche di scommessa. Scopriamo insieme le diverse risorse a vostra disposizione:

I pronostici sono fondamentali per anticipare i possibili esiti degli eventi. In questa sotto-sezione, vi forniremo analisi dettagliate degli eventi imminenti, consigli su come interpretare i vari fattori che possono influenzare il risultato di una partita o di una gara, e suggerimenti dagli esperti per fare scelte informate. Qui vi anticipiamo con gli ultimi pronostici sportivi realizzati dai nostri tipsters. Ecco tutti i pronostici disponibili:

Le quote sono il cuore delle scommesse sportive. Qui, imparerete a comprendere le quote offerte dai bookmakers, come esse riflettono le probabilità degli esiti degli eventi, e come sfruttarle a vostro vantaggio. Vi forniremo anche consigli su come individuare le quote di valore e scommettere in modo intelligente.

Risultati

Restare aggiornati sui risultati è essenziale. In questa sezione, troverete aggiornamenti in tempo reale sui risultati degli eventi sportivi, che vi aiuteranno a monitorare le vostre scommesse correnti e a pianificarne di nuove con maggiore consapevolezza. Controllate qui tutti i risultati della Serie A e se vuoi approfondire vi consiglio di approfondire nel menu.

Le classifiche sportive sono un importante indicatore delle performance delle squadre o degli atleti. Vi forniremo classifiche aggiornate e analisi su come queste possano influenzare le vostre decisioni di scommessa, aiutandovi a fare scelte più informate. Sono sicuro che ciò che vi interessa di più è la classifica della serie A, se non vuoi aspettare qui puoi controllarle all'istante!

Il mondo delle scommesse ha un suo linguaggio specifico. Nel glossario, troverete la spiegazione di tutti i termini tecnici, le espressioni più comuni e i concetti chiave del gioco. Questo strumento è essenziale per i principianti per orientarsi e per gli esperti per affinare ulteriormente le loro conoscenze.

Sicuramente per fare un sistema o una scommessa avrai bisogno di analizzare le quote e il margine di guadagno di ogni scommessa che realizzerai, ecco che le calcolatrici di scommesse sono il tuo alleato migliore.

Infine, esploreremo i vari sistemi di scommesse. Questa sezione vi insegnerà le diverse strategie di scommessa, come il sistema Martingale, Fibonacci, e altri, fornendo una guida su come applicarli in modo efficace per ottimizzare le vostre possibilità di successo nel mondo delle scommesse.

Domande Frequenti

Come Funzionano i siti di scommesse Online in Italia?

I siti di scommesse online in Italia sono piattaforme virtuali autorizzate dall'ADM che offrono una vasta gamma di giochi d'azzardo accessibili tramite Internet.

Gli utenti si registrano, depositano denaro reale e possono giocare a vari giochi come slot machine, poker, blackjack, roulette, scommesse sportive e altro ancora. Questi siti sono regolamentati per garantire l'imparzialità e la casualità dei risultati dei giochi.

Gli utenti si registrano, depositano denaro reale e possono giocare a vari giochi come slot machine, poker, blackjack, roulette, scommesse sportive e altro ancora. Questi siti sono regolamentati per garantire l'imparzialità e la casualità dei risultati dei giochi.

Come Scommettere sui bookmakers online in Italia?

Per scommettere su un bookmaker online in Italia, gli utenti devono registrarsi su un sito autorizzato dall'ADM e depositare fondi sul proprio account.

Dopo aver selezionato lo sport e l'evento su cui desiderano scommettere, scelgono il tipo di scommessa e confermano l'importo della puntata.

Le scommesse possono riguardare risultati di partite, punteggi, giocatori, e altro ancora, a seconda dell'offerta della piattaforma.

Dopo aver selezionato lo sport e l'evento su cui desiderano scommettere, scelgono il tipo di scommessa e confermano l'importo della puntata.

Le scommesse possono riguardare risultati di partite, punteggi, giocatori, e altro ancora, a seconda dell'offerta della piattaforma.

Qual è il sito di scommesse più Popolare in Italia?

Il sito di scommesse più popolare in Italia può variare in base alle preferenze personali e alle offerte specifiche. Siti come Snai, Bet365 e Sisal sono tra i più apprezzati per la loro affidabilità e varietà di offerte.

Quali sono i metodi di pagamento preferiti sui siti italiani?

I metodi di deposito più comuni per i giocatori italiani includono carte di credito e debito, PayPal, Postepay, Skrill, Neteller e bonifici bancari. Alcuni siti stanno iniziando ad accettare anche le criptovalute. La maggior parte dei siti di scommesse in Italia opera con l'Euro. È sempre consigliabile verificare le opzioni di valuta disponibili prima di piazzare una scommessa.

Posso fidarmi della sicurezza delle transazioni sui siti italiani?

Assolutamente. Scegliendo uno dei siti da me consigliati, potrete essere sicuri della sicurezza delle transazioni e della protezione dei vostri dati personali.

Il servizio clienti è efficiente e affidabile sui siti italiani?

Il servizio clienti è un punto di forza di molti di questi siti. Spesso è disponibile un'opzione di chat dal vivo, dove gli operatori sono pronti ad assistervi in tempo reale.

Qual è il Miglior Sito di Scommesse Online in Italia?

Il "miglior" sito di scommesse online in Italia dipende dalle preferenze individuali, dalle offerte di gioco, dalle quote, dalla sicurezza e da altri fattori. È consigliabile esaminare diversi siti, confrontare le offerte, leggere recensioni affidabili e valutare le proprie esigenze prima di scegliere la piattaforma di scommesse più adatta.

Ti consiglio di dare un'occhiata alla nostra guida riguardo Mazzanti Automobili un'acquisto da parte di Farantube Scommesse piuttosto interessante.